The first 91 days of 2024 provided unmistakable proof of a healthy, buoyant used car market. We saw the total number of auctions end rocket while the number of bids also increased dramatically.

A surge in auctions ended

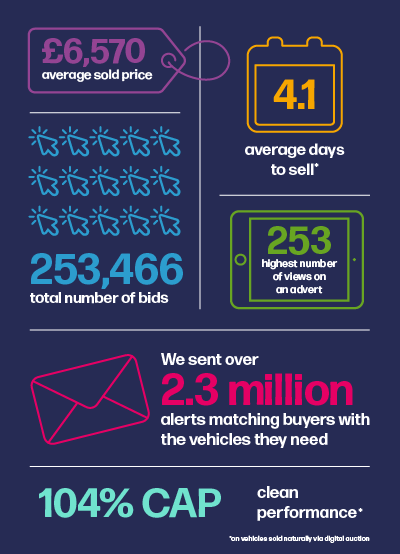

A typically busy time in the used car market, Q1 seems to have outdone itself this time round, with the total number of auctions ending on our platform soaring to nearly 34,000. That’s almost 1,000 more than the total recorded in the final quarter of 2023. Meanwhile, stock listed on Dealer Auction attracted 253,000 bids in Q1 compared to 198,000 this time a year ago – a 19% leap. It shouldn’t come as that much of a surprise though as we have ramped up the volume of vehicles on offer and have a generous range of stock sources, including Fleet, Franchise, Independent, Consumer, OEM and physical auction.

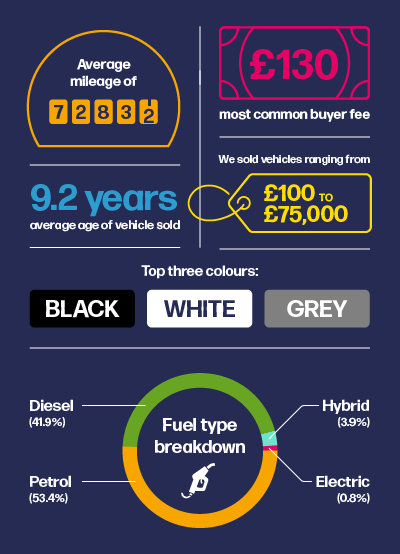

More EVs and older ICE

There’s been a marked shift in the age and mileage of vehicles selling on Dealer Auction, perhaps reflecting the much-publicised shortage of younger vehicles coming into the used market, a hangover from the pandemic when production of new vehicles was hit dramatically. We’ve seen fuel-type changes too: the number of diesel vehicles sold decreased while sales of hybrids and EVs rose. It’s a sure sign that more eco-friendly vehicles are now filtering through into the used market, something highlighted in Cox Automotive’s recent four-year fuel-type forecast.

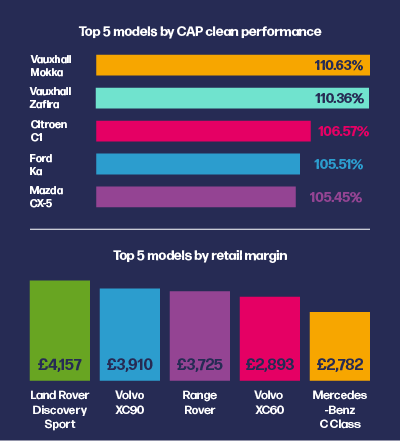

4x4s continue to dominate retail margin list

Bigger cars remain the key margin winners on Dealer Auction. Our rundown of the highest earners for Q1 has stalwarts including the Land Rover Discovery, which was no.2 at the end of Q4 2023, and the Volvo XC90 leading the charge. Indeed, Land Rover and Volvo hold the top four spots, while the Mercedes Benz C Class is in hot pursuit at no.5.

Our list of top five CAP clean performers has family cars taking the top two spots. However, the Citroen C1 city car managed to sneak in just behind the Vauxhall Mokka and Zafira.

Our latest Retail Margin Monitor, detailing the most profitable cars on the platform, can be read here.

We keep on going

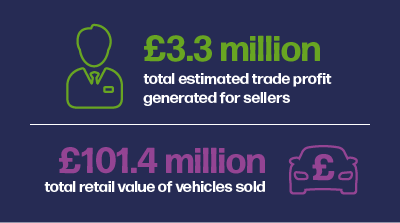

... With more stock sourced stock from the right places, Dealer Auction remains a very healthy and active marketplace that gives sellers great performance and trade profit. While buyers get all the relevant data needed to purchase the vehicles that make a healthy retail profit – all with some of the lowest buyer fees in the industry. Our sellers made an estimated £3.3m in trade profit in Q1 and buyers are voting with their bids, proving our platform is the place to go for choice, convenience and confidence.

The UK’s smartest digital wholesale marketplace

Dealer Auction makes buying and selling used vehicles easier and more profitable for everyone. Dealers not able to sell gap insurance are putting more focus on the profit their trade stock can generate. Buyers too, eager to keep pace with consumer demand and ensure their forecourts are filled, get access to thousands of vehicles from one simple login. Join the digital revolution and sign up today for a 30-day free trial.