Data from Dealer Auction’s EV Performance Review shows that alternatively fuelled vehicles (AFVs) traded between dealers in October were younger, carried fewer miles and were more profitable than the previous month.

The UK’s leading trade-to-trade platform saw a 10% rise in bids on EV and hybrid vehicles, while their average sold price (£15,706) also rose by 9.5% month-on-month, indicating the trade demand continues to be robust.

But the standout figures for the month were the changes in profile of the EVs and hybrids. The average age was 3.5 years, which was not only a fall from last month (4.1), but was also noticeably younger than the start of the year. There was also a significant drop in mileage in October: 32,456 from just under 38,000 in September – a fall of around 15% – indicating that younger models are moving quickly.

Ad views and retail margins also held steady with small increases of 1.8% and 2.8% respectively.

Dealer Auction’s Marketplace Director, Kieran TeeBoon, said: “As the automotive retail landscape continues to shift, interest in EVs and hybrids on our platform continues to grow. This monthly temperature check shows a flurry of younger vehicles on the move. The benefit is two-fold. Firstly, knowing there’s an active resale market might incentivise owners to trade in their low-mileage EVs sooner. Secondly, having less years and miles on the clock are traits that could encourage drivers who are in two minds to make the jump to electric or hybrid.”

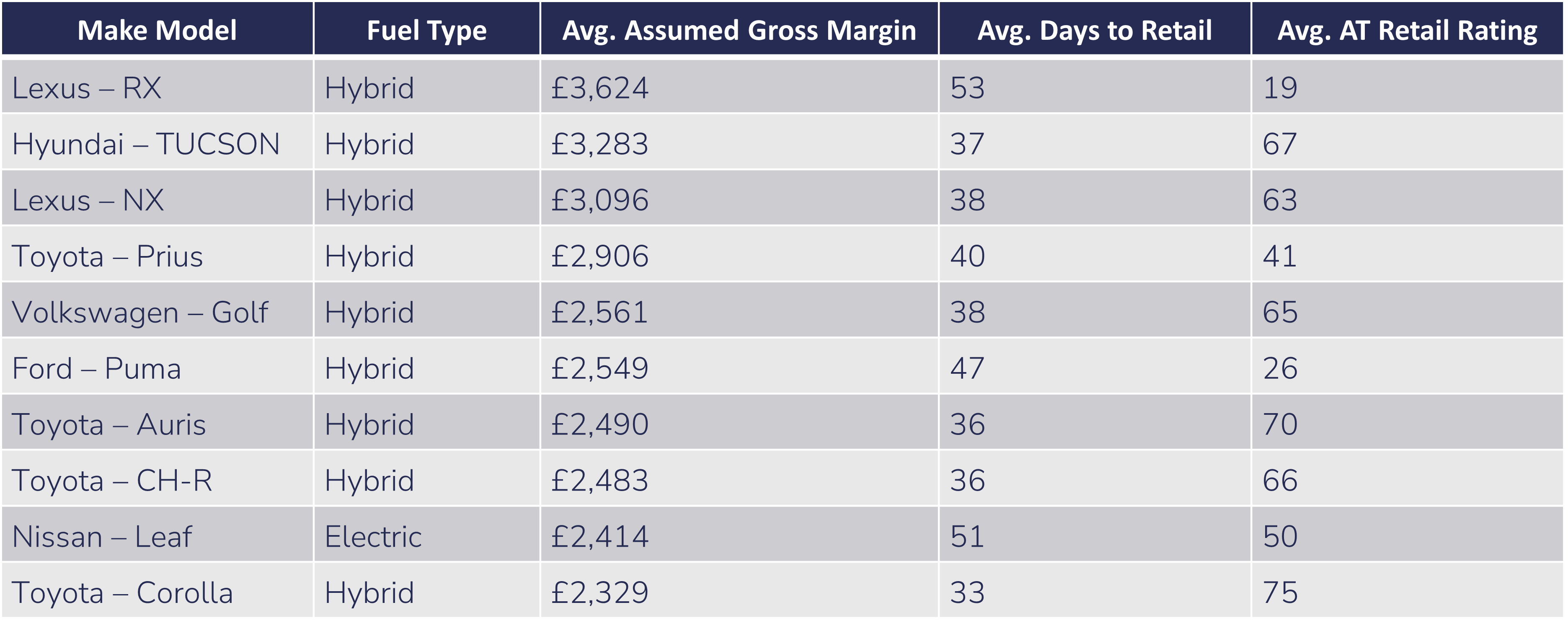

Hybrids continue to rule the AFV market, occupying all the spots in the top 10 vehicles by volume sold and top 10 by average gross margin, and 90% of the top 10 by CAP performance. The Renault Zoe is the only fully electric vehicle in the top 10 table, with a CAP performance of 124.7%. The Nissan Leaf, which has been a regular feature this year, slipped out of the top 10.

After topping the table in June and August, the Lexus RX once again took first place by average gross margin, with a potential margin of £3,944. But with the exception of Lexus, mainstream brands were the ones to watch for margin, CAP performance and volume.

Toyota continue their strong performance from September, holding six of the top 10 sold volume and two in top 10 by CAP performance and three in the top 10 by average gross margin. The fastest seller was the Mitsubishi Outlander, selling in 27 days on average. The Kia Niro, Toyota RAV4 and Hyundai Tucson were hot on its heels, selling between 30 and 32 days on average.

TeeBoon concludes: “The EV Performance Review continues to provide brilliant insights about a changing used market, showing AFVs proving a compelling option when replenishing their forecourts. October’s numbers are very positive, ahead of a traditionally challenging quarter. Even though they represent a small proportion, compared to ICE, it’s interesting to see how brands are shaping up for the remainder of 2024, in terms of EVs.

“It’s encouraging to see models command a strong margin, plus a healthy increase in the number of views that translate into bids. With so many different forces at play in the used car market, it’s more important than ever to be on top of changing consumer demand as it continues to shift towards sustainable mobility options.”

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in May 2024, Dealer Auction’s EV Performance Review (EVPR) is a monthly feature that tracks the performance and trends of EV and Hybrid vehicles on the UK’s leading digital remarketing platform.