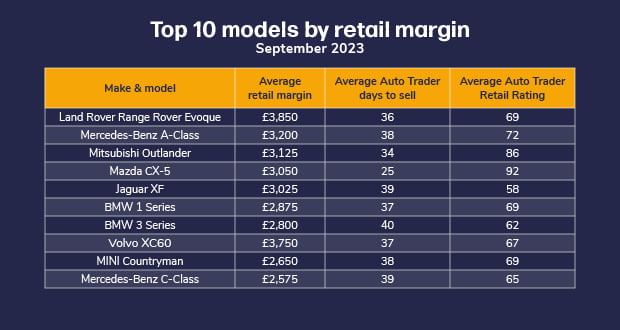

October 2023 – Data from Dealer Auction’s latest Retail Margin Monitor has revealed that the Mercedes-Benz A-Class hatchback was a top performer in September 2023. The model ranked in second place with an average retail margin of £3,200 – which is also the second highest margin achieved by a hatchback since the launch of the Retail Margin Monitor in January 2022.

Dealer Auction’s Marketplace Director, Kieran TeeBoon, commented: “Historically, the Retail Margin Monitor has been dominated by SUVs, so it’s interesting to see the performance of the A-Class in September. While this model has appeared in the Top 10 model table before, it hasn’t ranked higher than sixth place, which could indicate new profit opportunities.”

Elsewhere in the table, trends continued from previous months – including the Range Rover Evoque remaining in the top spot, with an average retail margin of £3,850.

The Mitsubishi Outlander also performed well in third place. It registered an average retail margin of £3,125 and was also the second-quickest seller – selling in 34 days on average. The Mazda CX-5 proved the fastest-selling profit-turner for the fourth month in a row, selling in just 25 days on average.

The latest Retail Margin Monitor comes hot on the heels of cap HPI anticipating a surge in vehicle volumes entering the wholesale market in October, due to increased fleet returns and higher part-exchange availability resulting from September’s registration activity*.

“Dealers therefore need to use all of the available data and insights to identify where to focus their efforts amid all of this incoming preowned stock,” says TeeBoon.

At brand level, Land Rover once again topped the table with an average retail margin of £3,875, followed by BMW (£3,125) and Jaguar (£3,075). The brand table was dominated by premium marques, but interestingly, mainstream brand Škoda entered the table for the first time ever, clocking an average retail margin of £2,225 to secure the 10th spot.

TeeBoon concluded: “It’s clear that mainstream brands shouldn’t be underestimated for their profit potential. Recent months have seen good representation from Volkswagen, Nissan and Kia in the Retail Margin Monitor – and now Škoda is entering the fray. It’s also worth noting that three mainstream products are sitting just outside the top 10 model table: the Peugeot 2008, the Ford EcoSport and the Ford Kuga.

“As we enter Q4 – historically a challenging quarter for the industry – it’s these unique opportunities for extra profit that dealers want to be honing in on when restocking.”

Richard Walker, Director of Data and Insights at Auto Trader, the UK’s largest automotive marketplace, added: “For the vast majority of the market, we’re seeing robust levels of price growth being stimulated by a combination of strong demand and constrained stock, and so whilst overall figures may continue to soften over the coming months due to changes in supply dynamics, the market remains profitable which is clearly shown by the models and brands showcased in the Retail Margin Monitor.

“The line between winners and losers in the market will be drawn entirely on retailers’ use of data to make smart decisions in specific pockets of the market.”

*https://cap-hpi.exposecms.com/file-uploads/20230926075250_Car-Market-Overview-Oct23.pdf

Take us for a test drive.

Curious about what you see? Then why not try Dealer Auction for free for 30 days?

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £25,000. We then compare the sold price for each model with the Auto Trader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold. We crunch the numbers at the start of every new month.

Notes:

The average ‘Auto Trader Retail Rating’ uses three key metrics to determine the consumer demand for the vehicle:

- Average days to sell – Calculated for the whole of the UK and then adjusted for the variations Auto Trader have observed locally in your area.

- Live market supply – Comparing the national supply level for the vehicle over the last seven days with the usual level of supply Auto Trader have seen in the market over the last six months.

- Live buyer demand – Analysing how many people are currently searching for the vehicle on Auto Trader, comparing consumer search behaviour over the last seven days against the level of interest over the last six months.