Competition for used hybrids and EVs listed on Dealer Auction rose in June, signifying an ongoing appetite among dealers for these Alternative Fuel Vehicles (AFVs) even as volumes are squeezed.

The digital platform’s new EV Performance Review reports a flurry of trade-to-trade deals were evident throughout the month despite the overall volume of these vehicle types being listed dropping compared to May. There were 29% fewer EVs and 11% fewer hybrids listed, but the number of bids per vehicle increased 13%. The proportion of EVs selling increased 32% vs May, while hybrids maintained the level of interest seen last month.

Kieran TeeBoon, Dealer Auction Marketplace Director, comments: “We saw a sharp decline in the number of hybrid and electric vehicles listed during June but a step up in the number of bids for that vehicle pool, and more EVs sold. This clearly indicates dealers want these vehicles for their forecourts and are prepared to fight for them.”

“It’s too early to draw meaningful conclusions on the ups and downs of the used EV market, but I would speculate that dealers are increasingly retaining these vehicles for retail on their own forecourts. As EVs gain traction in the used market but new volumes continue to stall amongst private buyers, I think this is a likely scenario and one we will be watching with interest. We are working hard to counter this by bringing new fleet AFV stock to Dealer Auction, including over 50 EVs a month from Novuna.”

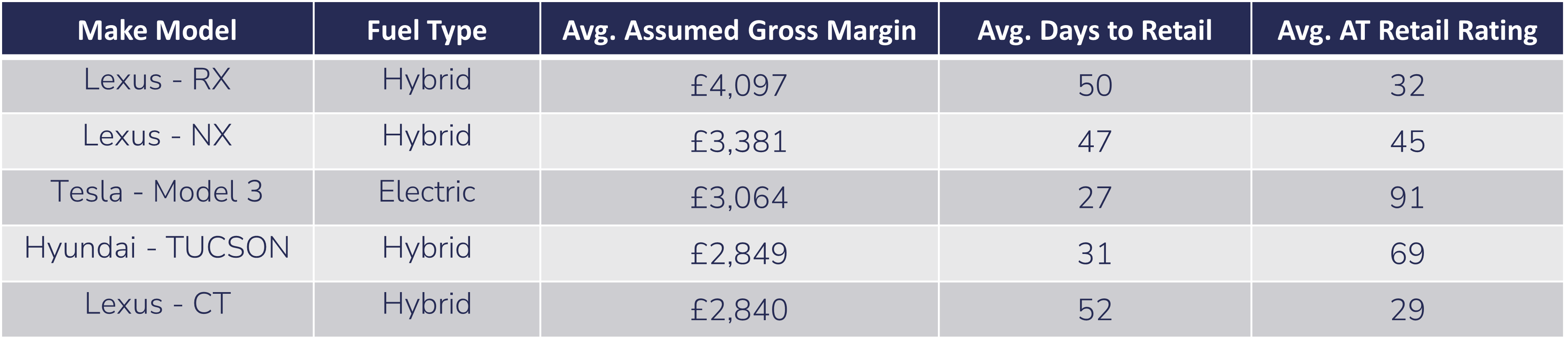

Hybrid vehicles occupied eight of the top 10 retail margin league table places, with Lexus taking the first, second and fourth places with its RX, NX and CT hybrid variants. The RX topped the chart with an average assumed gross margin of £4,124.

Tesla’s Model 3 jumped into third place after not appearing in the list at all in May, with a margin potential of £3,095. The compact Tesla also set a new days-to-retail benchmark of 25 days, half that estimated for the chart-topping Lexus RX and well below the top 10 average of 41 days. At 92 the Tesla also has, by some margin, the highest Auto Trader Retail Rating of the top 10.

Hybrid vehicles also dominated Dealer Auction’s AFV CAP performance league table, taking nine of the top 10 places. The Model 3 was the only EV variant to make the list, while Toyota’s RAV4 topped the table at 117.8%, up significantly from the 96.6% figure the same model recorded in May.

The average CAP performance of the top 10 rose from 97.9% in May to 100.7% in June. The average sold price for AFVs remained steady, just 0.4% up on May’s figure despite the volume change, while the average age decreased slightly to 4.9 years.

TeeBoon concludes: “This is only our third monthly EV Performance Review but already it’s painting a picture of a market that’s establishing itself, and the month-on-month movements underline just how young this space still is. What is becoming clear however is there is demand for used EV and hybrid product and the margin potential is comparable to their ICE equivalents.

“As volumes come into the market in larger numbers, we will be monitoring the data and sharing what we find. This is an exciting new segment and something every dealer should be watching with great interest.”

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in May 2024, Dealer Auction’s EV Performance Review (EVPR) is a monthly feature that tracks the performance and trends of EV and Hybrid vehicles on the UK’s leading digital remarketing platform.