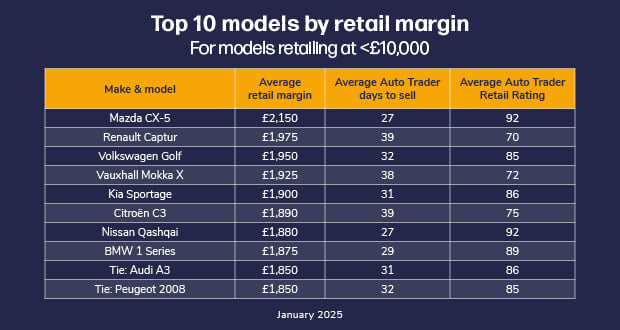

February 2025 – Dealer Auction’s Retail Margin Monitor has revealed the Mazda CX-5 provided dealers with the highest profit potential in the sub-£10,000 retail bracket in January 2025. The premium SUV had a strong start to the year with an average retail margin of £2,150. It was also a strong performer across other metrics – it was the joint fastest seller of the top 10 (27 days on average) and achieved an Average Auto Trader Retail Rating of 92.1

The Renault Captur followed with an annual average retail margin of £1,975, while the Volkswagen Golf came third (£1,950). Several top-profit-making models from 2024 continued to deliver strong returns, including the Renault Captur, BMW 1 Series and Kia Sportage – although notably, the 2024 top model, the Ford Kuga, fell out of the top 10 this month. Another standout model for January was the seventh-place Nissan Qashqai, which matched the Mazda’s days-to-sell and Average Auto Trader Retail Rating, as well as clocking a healthy average margin (£1,880).

This is the first monthly Retail Margin Monitor since the platform changed the way it publishes its data – splitting the data set into two brackets: vehicles with a retail value of £0–£9,999 and over £10,000. “It’s a new year and this new way of publishing our data is already creating some intriguing talking points,” said Dealer Auction’s Marketplace Director, Kieran TeeBoon.

“But as well as giving more ‘airtime’ to the models in the price-point most commonly sold by our dealers, it also amplifies trends seen in previous Retail Margin Monitors. The speed-to-sale of the Mazda CX-5 has previously been spotlighted in 2023 and 2024, and it holds the record as the fastest selling profit-maker – selling in 23 days in May 2023. This gives extra context to its stellar performance in January 2025 – it’s certainly one keep on your radar this year!”

Looking at the data for models retailing above £10,000, there were some surprises, with Land Rover models failing to make the top two spots. The Volvo XC90 topped the chart with an average retail margin of £4,275, followed by the Jaguar F-PACE (£3,900) and Range Rover Evoque (£3,850). The Land Rover Discovery Sport dropped into fourth with an average retail margin of £3,450.

TeeBoon observed: “Regular readers of the Retail Margin Monitor will have seen either the Discovery Sport or Range Rover Evoque taking the top spot each month in 2024. January 2025 marks a very competitive top 10 and it’s encouraging to witness the new opportunities for hitting that top profit. This underscores the importance of versatility, where current market demand and profit-potential should dictate your stock-buying decisions, not just previous performance or auction hammer prices!”

At brand level, in the top 10 makes for models with a retail value of under £10,000, BMW followed its strong 2024 performance by topping the chart once more in January 2025. Its average profit of £2,150 was followed by Audi (£2,025) and Mazda (£1,925).

Interestingly, two strong performers from 2024 – Volvo and Mercedes-Benz – dropped out of the sub-£10,000 chart for this month, but they are present in the table for higher retailing models. Indeed, in the top 10 for makes with models retailing above £10,000, Volvo came second with an average retail margin of £3,325. Land Rover came top (£4,400), while BMW came in third (£3,225).

TeeBoon concluded: “There are lots of key takeaways that could influence dealers’ angles of attack for seeking extra margin in 2025. It’s clear that ‘quality stock’ will very much be about desirability in 2025, so it’s important to stock up with a variety of price points to appeal to a broad customer base. At Dealer Auction, we’re looking forward to once again being by dealers’ sides in finding those unique avenues for profit. 2025, we’re ready for you!”

Take us for a test drive.

Curious about what you see? Then why not try Dealer Auction for free for 30 days?

About Dealer Auction

Dealer Auction is the UK’s leading digital remarketing platform. We give buyers and sellers more choice, better insight and greater margins. Dealer Auction is an independent company, created through a joint venture between Cox Automotive and Auto Trader. For more information, visit www.dealerauction.co.uk.

Launched in January 2022, Dealer Auction’s Retail Margin Monitor tracks the potential retail margin that can be achieved on vehicles bought via Dealer Auction’s open network. We track models meeting two key criteria: more than 20 units sold with a retail price of less than £25,000. We then compare the sold price for each model with the Auto Trader market average to reveal the potential margin. For the brand table, we compare models with more than 50 units sold. We crunch the numbers at the start of every new month.

Notes:

1The average ‘Auto Trader Retail Rating’ uses three key metrics to determine the consumer demand for the vehicle:

- Average days to sell – Calculated for the whole of the UK and then adjusted for the variations Auto Trader have observed locally in your area.

- Live market supply – Comparing the national supply level for the vehicle over the last seven days with the usual level of supply Auto Trader have seen in the market over the last six months.

- Live buyer demand – Analysing how many people are currently searching for the vehicle on Auto Trader, comparing consumer search behaviour over the last seven days against the level of interest over the last six months.

2 https://coxautomotive.h5mag.com/insight_quarterly_q4/the_used_market

3 https://plc.autotrader.co.uk/news-views/press-releases/retail-price-index-december-2024/